In addition to serving as a learning mechanism, blogging gives me an opportunity to think out loud. Not exactly news, but still quite important. Retirement Savings and Annual Spending, another highly-read post from 2016, discusses the frightening level of under-saving for retirement in the U.S. About Fidelity's Health Care Cost Estimate for Retirees considers AARP's statement that health care costs will consume most of the future Social Security benefits for some households. One of the most-read posts of 2016 was on the topic of health care costs in retirement. An investment plan is only one piece of the puzzle. In Retirement Plan or Investment Plan?, I cautioned that any plan that only addresses asset allocation and withdrawals isn't a retirement plan – it's an investment plan. Despite this, most retirement plans focus heavily on the income side of the equation. In Expense Risk in Retirement, I noted that the expense side of the retirement finance equation is at least as important as the income side and it's probably riskier.

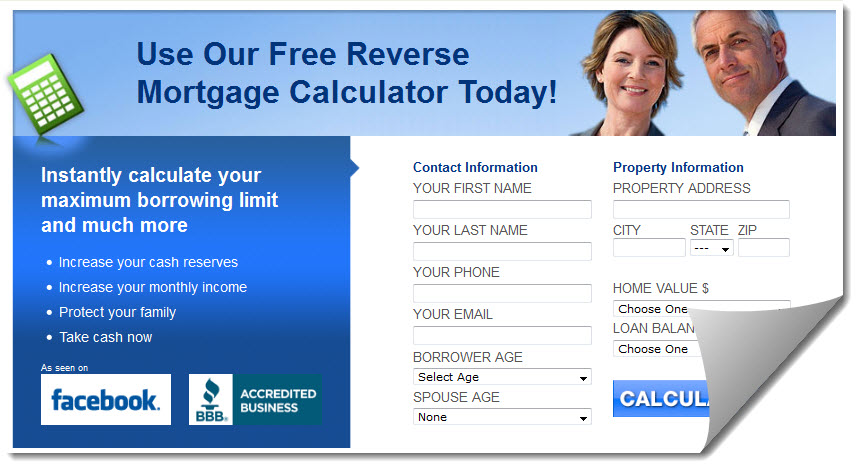

What we really want to know is not the probability that we will die or go broke sometime during retirement, but those conditional probabilities given that we have reached a certain age: what is the probability that I will go broke or die given that I am now 77 years old, still alive and not already broke? It explains the difference between absolute and conditional probabilities of death or depleting one's savings. The upliftingly-named Death and Ruin is a post about the aforementioned paper I published under the same title with my kids. I typically check my portfolio a couple of times a year.Ģ016: How I published a paper, ate a piranha and climbed past Machu Picchu. What I Do When the Market Tumbles? Not much, because my portfolio equity allocation (about 45% equities) is set such that I am unlikely to lose more than I can stomach. Bankruptcy is typically a result of spending shocks, not poor market returns. You can reach me at started off 2016 with Why Retirees Go Broke. It is now in the bio section of every post. I also learned from a reader that my email address had disappeared. I now put most links at the bottom of the post so people aren't tempted to jump to links until they've read the entire post. I test it with a nifty Google tool for mobile ease of use before publishing. Here's a quick review of some things I learned in 2016.įirst, I learned that the march to mobile devices continues unabated, so I redesigned my blog to be easier to read from smart phones. I spent a couple of months doing background research on reverse mortgages before posting about them, for example.

I find that writing blog posts is the best way to educate myself. The casual observer might assume my blog's goal is to educate people about retirement finance, but it's actually the opposite. I also blogged on several topics in 2016. It was a pretty good year for an old guy.

0 kommentar(er)

0 kommentar(er)